12-11-2024

In Chancellor Rachel Reeves’ 2024 Autumn Budget, she announced over £40 billion of tax increases, as the Government attempts to fill a £22 billion gap in public finances. The headline measure was a rise in employer National Insurance Contributions (NICs), from 13.8 per cent (where applicable) to 15 per cent. The Chancellor also reduced the

Find out more

12-11-2024

Capital Gains Tax (CGT) was a significant target for the Chancellor in the Autumn Budget – with an immediate rise put in place for both the basic and higher rate of CGT. The basic rate paid by basic rate taxpayers rose immediately to 18 per cent – up from 10 per cent. Meanwhile, the higher

Find out more

30-10-2024

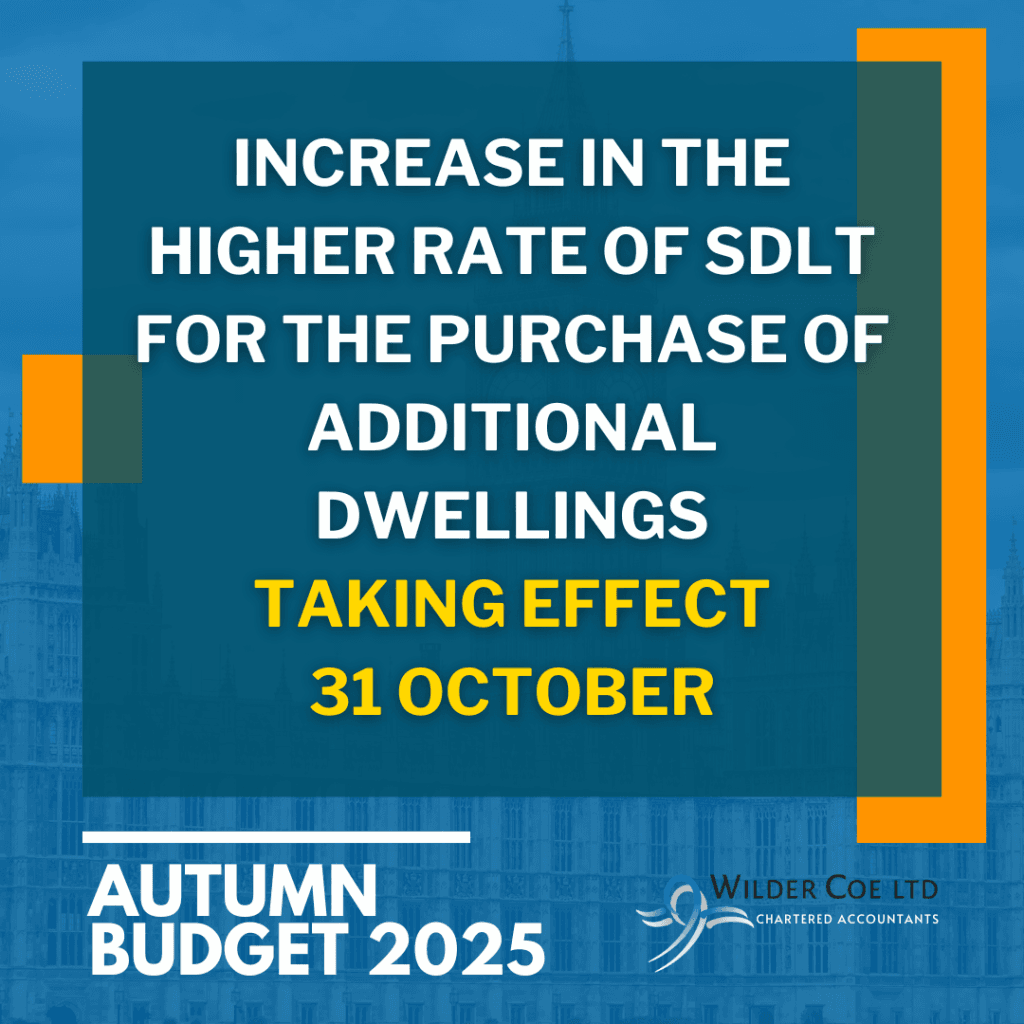

Today the Chancellor Rachel Reeves announced an immediate change in the rate of Stamp Duty Land Tax (“SDLT”) on the purchase of additional residential properties. These measures will take effect for all transactions entered into on or after 31 October 2024. When does the higher rate apply? When an individual purchases an additional residential property

Find out more

30-10-2024

A new Government, a new Chancellor and a new approach to the UK’s fiscal policies. Rachel Reeves entered her first Budget with a strong message that her measures would lead to “an economy that is growing, creating wealth and opportunity for all”.

Find out more

22-10-2024

Capital allowances are a great way to reduce your tax liabilities by claiming deductions on certain property-related expenses. They allow you to offset the cost of capital expenditure – plant, machinery and certain fixtures – against your taxable profits, especially if you have invested in commercial properties or made major improvements. Who is eligible to

Find out more

22-10-2024

Taxpayers have a fundamental right to reclaim input tax, also referred to as input VAT. However, HMRC has the authority to refuse this right under certain conditions if they can demonstrate that the taxpayer was aware, or should have been aware, that their transactions were linked to fraud. There has been a noticeable rise in

Find out more

22-10-2024

As the Autumn Budget approaches, the Government has pledged that it will “make the tax system fairer” and avoid raising taxes on working people and certain businesses. The Government has said that it will not raise: Income Tax National Insurance (NI) Corporation Tax VAT While Corporation Tax is not levied on individuals, the fact that

Find out more

22-10-2024

For business owners and directors, dividends may form a critical element of your salary strategy and tax planning, keeping your tax liabilities to a minimum. To extract profit tax-efficiently from your business, you may use a combination of: Salary – Typically set at or around the Personal Allowance of £12,570 to minimise Income Tax and

Find out more

22-10-2024

As the Government seeks to plug certain gaps in the public purse, we are unlikely to see any change in Income Tax thresholds – despite wages and the State Pension rising. Under the previous Government, tax thresholds were frozen until March 2028, and it remains to be seen whether this will change under the Labour

Find out more

22-10-2024

Labour shortages, particularly in the hospitality sector, are creating significant challenges for many businesses this year. Managing your costs while trying to maintain service quality and customer relations can be a difficult balance. Given the difficulty in hiring sufficient staff, many of you will be investing in technology to increase your efficiency. Luckily, the Annual

Find out more

22-10-2024

Labour’s Autumn Budget is just around the corner (30 October) and many businesses are uncertain of what the next few years may hold for them. The Prime Minister Keir Starmer has already warned of a “painful” Budget, with big changes to taxation, funding for public services, and incentives for investment. For businesses, these changes can

Find out more

14-10-2024

Our Wilder Coe team were delighted to attend Stevenage Community Trust’s annual Dinner & Dance on Friday 4th October. The black-tie gala helps fundraise for local charities in and around Stevenage and surrounding villages with a silent auction and raffle. Faye Thompson, Head of Cloud Accounting said, “Our first appearance at the black-tie charity event

Find out more